Tax Incentives

Commercial and Industrial Sales & Use Tax Exemption

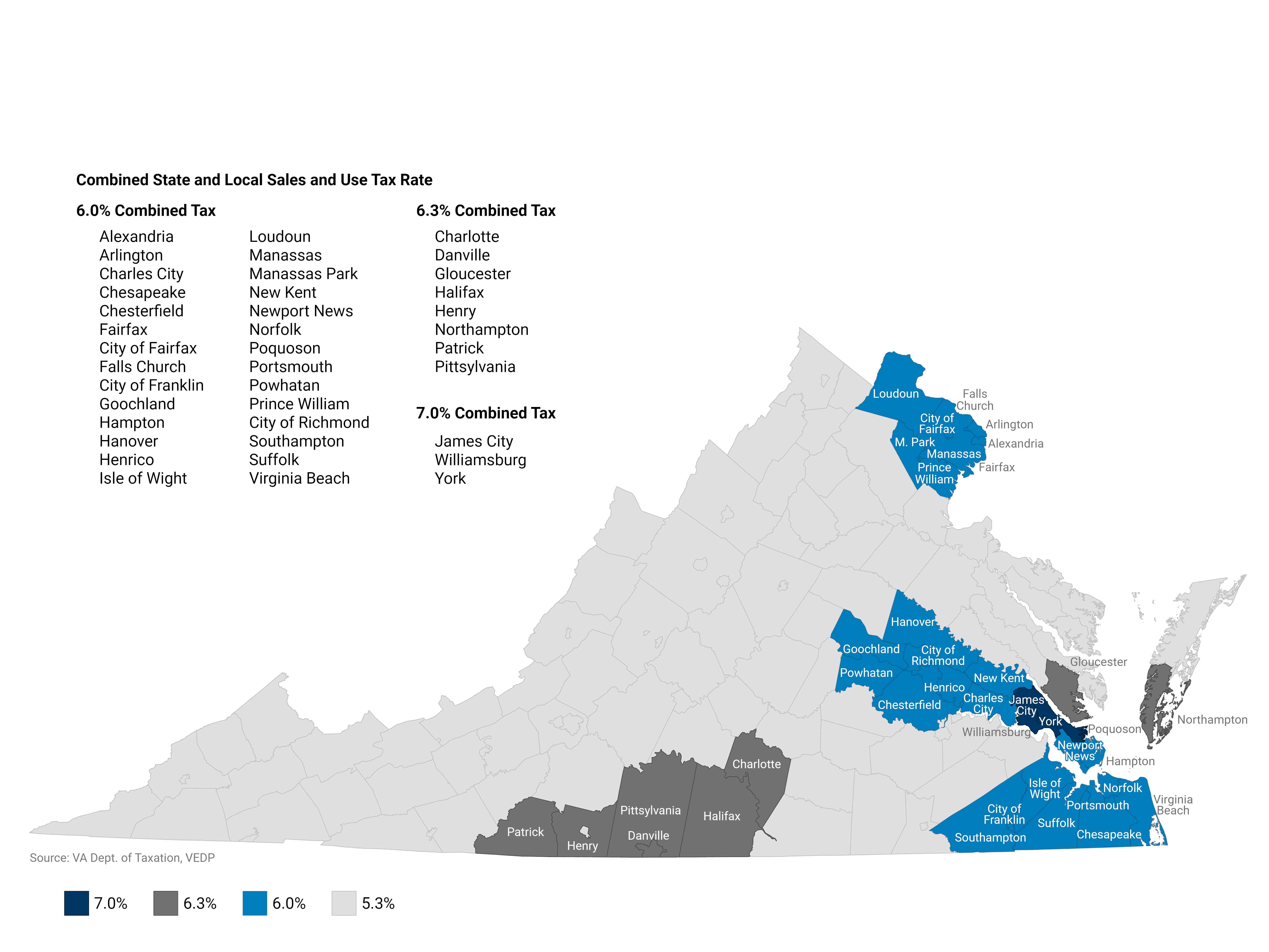

Virginia offers sales and use tax exemptions for eligible equipment used directly in manufacturing and research and development operations. Prior to exemptions, the Commonwealth’s combined state and local sales and use tax is 5.3% (4.3% state tax and 1.0% local tax). An additional sales tax is imposed in the Hampton Roads, Northern Virginia, and Richmond regions for a total 6.0% rate, in the City of Danville and counties of Charlotte, Gloucester, Halifax, Henry, Northampton, Patrick and Pittsylvania for a total 6.3% rate, in the counties of James City, York, and the city of Williamsburg for a total of 7.0%.

Eligibility

Some important exemptions include:

- Manufacturers’ purchases used directly in production, including machinery, tools, spare parts, industrial fuels, and raw materials

- Items purchased for resale by distributors

- Certified pollution-control equipment and facilities

- Custom computer software

- Utilities delivered through lines, pipes, or mains

- Purchases used directly and exclusively in research and development in the experimental or laboratory sense

- Most film, video, and audio production-related purchases

- Machinery, tools, and equipment of a public corporation used to generate energy derived from sunlight or wind

- Charges for internet access and sales of software via the internet

- Purchases used directly and exclusively in activities performed in cooperation with the Virginia Commercial Space Flight Authority

- Semiconductor clean rooms or equipment and other tangible personal property used primarily in the integrated process of designing, developing, manufacturing, or testing a semiconductor product

- Computer equipment purchased or leased for the processing, storage, retrieval, or communication of data in large data centers

- Machinery, tools, equipment, and materials used by a licensed brewer in the production of beer, and materials such as labels and boxes for use in packaging and shipment for sale

Process

- When purchasing qualified equipment, the eligible company completes Form ST-11, which it provides to the seller.

- The seller does not collect the retail sales and use tax on the qualifying equipment, but is then responsible for keeping the completed Certificate of Exemption on hand for their records if needed at a later date.

Resources

FAQ

What localities have the additional 0.7% tax in the Hampton Roads region?

The additional 0.7% regional rate in Hampton Roads applies to the cities of Chesapeake, Franklin, Hampton, Newport News, Norfolk, Poquoson, Portsmouth, Suffolk, Virginia Beach, and Williamsburg; and the counties of Isle of Wight, James City, Southampton, and York. An additional 1% is imposed in City of Williamsburg and the Counties of James City and York, for a total 7.0% rate.

What localities have the additional 0.7% tax in the Richmond region?

The additional 0.7% regional rate in the Richmond area is effective beginning October 1, 2020 and applies to the city of Richmond; and the counties of Charles City, Chesterfield, Goochland, Hanover, Henrico, New Kent, and Powhatan.

What localities have the additional 0.7% tax in the Northern Virginia region?

The additional 0.7% regional rate in Northern Virginia applies to the cities of Alexandria, Fairfax, Falls Church, Manassas, and Manassas Park; and in the counties of Arlington, Fairfax, Loudoun, and Prince William.

When is the retail sales and use tax due?

Retail sales and use tax is due when such property is either (i) delivered to the purchaser, or (ii) paid for in full by the purchaser, whichever occurs first, regardless of when the property is ordered. As such, this is when the exemption must be claimed. This is not a refund given after paying the sales and use tax.

What if, after reading the list of items eligible for the tax exemption, it is still unclear whether a specific item will qualify?

Contact the Virginia Department of Taxation at 804.367.8037.