Regional & Local Assistance

Foreign Trade Zones (FTZs)

Foreign trade zones allow businesses to defer paying U.S. Customs duties on imported goods held within the zones until the goods enter the United States for domestic consumption. No duties are paid if goods are re-exported. Companies also receive the benefit of not having to pay duties on broken or scrapped product. Businesses are allowed to store goods within FTZs for an unlimited period of time. They are also allowed to manufacture products within FTZs and pay duties at the duty rate of either the foreign parts used or on the finished product, whichever is most advantageous to the company.

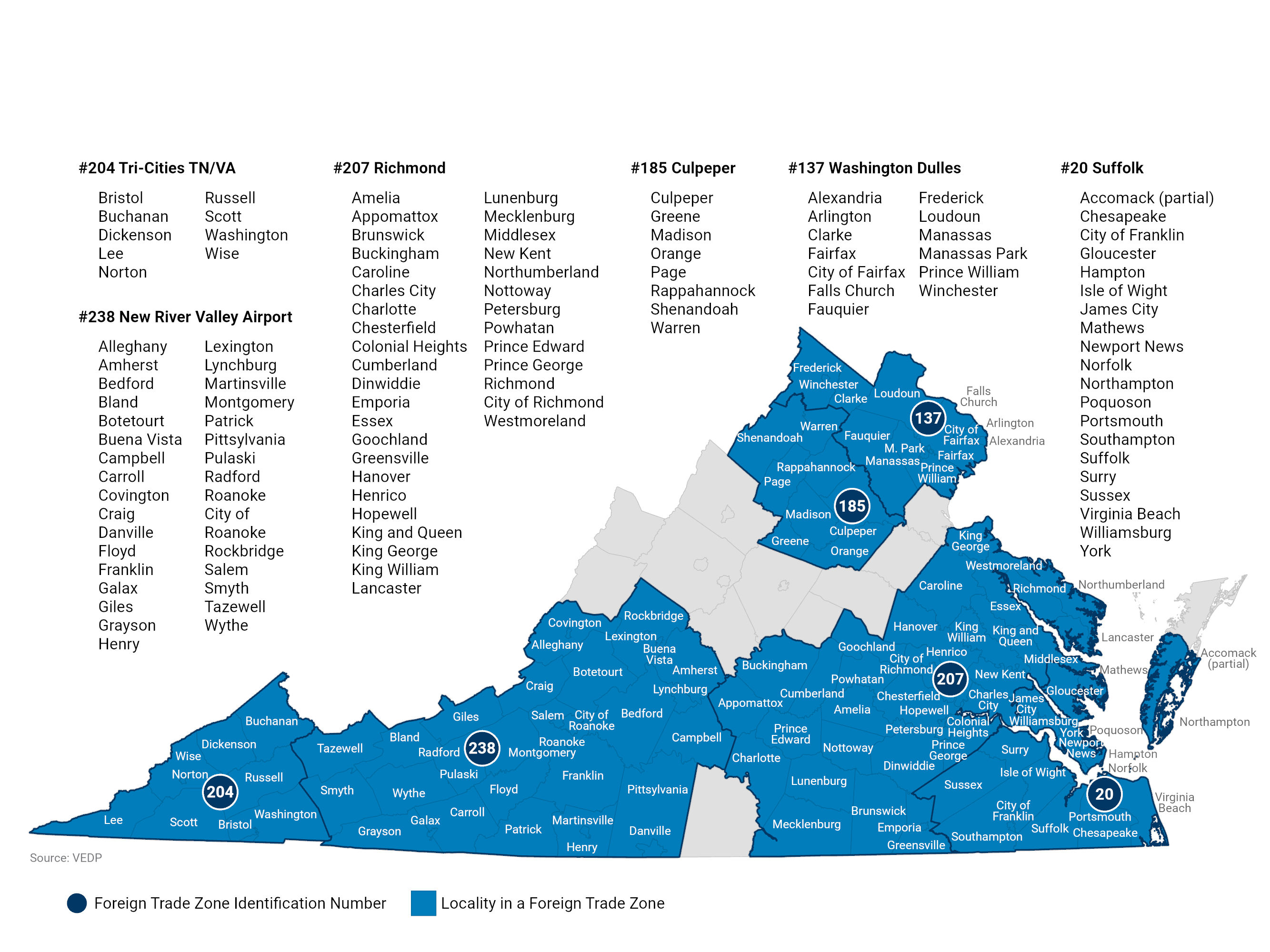

Virginia offers six foreign trade zones designated by the U.S. Department of Commerce. Each of Virginia’s six FTZs are Alternative Site Framework (ASF) designated, which allows greater flexibility when adding new zone operations as well as expedited FTZ Board applications. Any property within the ASF-designated area of a particular FTZ can obtain status as a usage-driven FTZ site. All zones provide space for storage, distribution, and light assembly operations.

Contact

Niki Wilson RIC Properties & Concessions Manager, Capital Region Airport CommissionEligibility

Any company that imports product into the United States and does any of the following processes could qualify for the Foreign Trade Zone program. Merchandise in a zone can be assembled, cleaned, displayed, destroyed, exhibited, manipulated, manufactured, mixed, processed, relabeled, repackaged, repaired, salvaged, sampled, stored, or tested.

Activated businesses in an FTZ can reduce or eliminate duty on imports and take advantage of other benefits to encourage foreign commerce within the United States.

For more information regarding zone benefits and eligibility, contact the zone administrators listed below:

Suffolk (FTZ #20)

The Virginia Port Authority administers Virginia’s first foreign trade zone. FTZ #20 is the most active in the Commonwealth and has a service area that includes Accomack (partial), Gloucester, Isle of Wight, James City, Mathews, Northampton, Southampton, Sussex, Surry, and York counties, and the cities of Chesapeake, Franklin, Hampton, Newport News, Norfolk, Poquoson, Portsmouth, Suffolk, Virginia Beach, and Williamsburg. Also, North Carolina counties of Camden, Chowan, Currituck, Elizabeth City, Gates, Hertford, Pasquotank, and Perquimans.

Contact: Laura Swankler — 757.683.2135

Washington Dulles (FTZ #137)

Foreign trade zone #137 is located at Washington Dulles International Airport with two operators using the Alternative Site Framework (ASF) zones. The grantee of FTZ #137 is Washington Dulles Foreign Trade Zone, Inc. Service area includes Frederick, Clarke, Loudoun, Fairfax, Fauquier, Prince William and Arlington counties and the City of Alexandria.

Contact: Lisa Merhaut — 703.572.8714

Culpeper (FTZ #185)

Located in north-central Virginia, the Culpeper foreign trade zone includes Culpeper, Greene, Madison, Orange, Page, Rappahannock, Shenandoah, and Warren counties.

Contact: Bryan Rothamel — 504.229.7893

Tri-Cities TN/VA (FTZ #204)

Foreign trade zone #204 has a service area in Virginia covering Buchanan, Dickenson, Lee, Russell, Scott, Washington, and Wise counties, and the cities of Bristol and Norton. The grantee of FTZ #204 is the Tri-Cities Airport Authority.

Contact: Mark Canty — 423.367.2385

Richmond (FTZ #207)

Central Virginia’s FTZ #207 includes on-airport warehousing options at Richmond International Airport and over 100 acres available for development on-airport. Additional magnet sites are located in Ashland, Prince George, and South Hill. The approved ASF service area includes Amelia, Appomattox, Brunswick, Buckingham, Caroline, Charles City, Charlotte, Chesterfield, Cumberland, Dinwiddie, Essex, Greensville, Goochland, Hanover, Henrico, King and Queen, King George, King William, Lancaster, Lunenburg, Mecklenburg, Middlesex, New Kent, Northumberland, Nottoway, Powhatan, Prince Edward, Prince George, Richmond, and Westmoreland counties, and the independent cities of Colonial Heights, Emporia, Hopewell, Petersburg, and Richmond.

Contact: Russ Peaden — 804.226.8520

Onward New River Valley (FTZ #238)

FTZ #238’s service area encompasses 22 counties and nine cities in southern, central, and southwest Virginia, and includes a 35-acre general-purpose zone at the New River Valley Airport in Dublin. Service area includes Alleghany, Amherst, Bedford, Bland, Botetourt, Campbell, Carroll, Craig, Floyd, Franklin, Giles, Grayson, Henry, Montgomery, Patrick, Pittsylvania, Pulaski, Roanoke, Rockbridge, Smyth, Tazewell, and Wythe counties, and the cities of Bedford, Buena Vista, Covington, Danville, Galax, Lynchburg, Martinsville, Radford, Roanoke, and Salem.

Contact: Samantha Livesay — 540.230.3083

Process

- Companies interested in FTZ contact the local grantee.

- Federal application for site designation.

- Grantee will obtain comments from local Customs and Border Protection office

- Grantee will submit proposed user’s application to the Foreign Trade Zones Board

- 30-day approval time for ASF Minor Boundary Modification

- Production notification.

- Production notification is only needed if "Activity involving the substantial transformation of a foreign article resulting in a new and different article having a different name, character, and use, or activity involving a change in the condition of the article which results in a change in the customs classification of the article or in its eligibility for entry for consumption (15 CFR 400.2(o))”

- FTZ staff will send a letter to CBP requesting comments after the application has been formally docketed

- 120-day approval time

- Activation with U.S. Customs and Border Protection.

- Grantee will notify user when FTZ Board has approved the site

- CBP and FTZ user can now begin activation.

- Standard approval time 3-6 months

Resources

FAQ

A fuller list of frequently asked questions is provided by the Foreign Trade Zones Board. Click here to access.

What is a foreign trade zone?

A foreign trade zone is a designated location in the United States where companies can use special procedures that help encourage U.S. activity and value added – in competition with foreign alternatives – by allowing delayed or reduced duty payments on foreign merchandise, as well as other savings.

A site which has been granted zone status may not be used for zone activity until the site has been separately approved for FTZ activation by local U.S. Customs and Border Protection (CBP) officials, and the zone activity remains under the supervision of CBP. FTZ sites and facilities remain within the jurisdiction of local, state, or federal governments or agencies.

What is the ASF?

The "alternative site framework" (ASF) is an optional framework for organizing and designating sites that allows zones to use quicker and less complex procedures to obtain FTZ designation for eligible facilities.

To reorganize under the ASF, each zone grantee will propose a "service area." Once approved by the FTZ Board, a subzone or usage-driven site can be designated anywhere in the service area within 30 days using a simple application form. The ASF allows zone designation to be brought to any company that needs it, eliminating the need for zone grantees to predict where the zone will be needed and pre-designate sites.

Does a company already have to be located in an FTZ to use the program?

No. The FTZ Board has quick, straightforward procedures for working with local FTZs to create a "subzone" or "usage-driven site" at a facility.

What activity is permitted in zones?

Merchandise in a zone may be assembled, exhibited, cleaned, manipulated, manufactured, mixed, processed, relabeled, repackaged, repaired, salvaged, sampled, stored, tested, displayed, and destroyed. Production activity must be specifically authorized by the FTZ Board. (Production activity is defined as activity involving the substantial transformation of a foreign article or activity involving a change in the condition of the article which results in a change in the Customs classification of the article or in its eligibility for entry for consumption.) Retail trade is prohibited in zones.

What are the benefits to a zone user?

- Duty Exemption. No duties or quota charges on re-exports.

- Duty Deferral. Customs duties and federal excise tax deferred on imports.

- Logistical Benefits. Companies using FTZ procedures may have access to streamlined Customs procedures (e.g., "weekly entry" or "direct delivery").

- Other Benefits. Foreign goods and domestic goods held for export are exempt from state and local inventory taxes. FTZ status may also make a site eligible for state and local benefits that are unrelated to the FTZ Act.

Where can a Zone Site be located?

Zone sites must be within or adjacent to a U.S. Customs and Border Protection (CBP) port of entry.

The adjacency requirement can be satisfied if one of the following factors is met:

- The zone or subzone site is within the limits of a CBP port of entry.

- The zone or subzone site is within 60 statute miles of the outer limits of a CBP port of entry.

- The zone or subzone site is within 90 minutes' driving time from the outer limits of a CBP port of entry as verified by the CBP Service Port Director.

For subzones only: subzone sites that are outside the 60 miles/90 minutes driving time from the outer limits of the CBP port of entry may alternatively qualify to be considered adjacent if they work with the CBP Port Director to ensure that proper oversight measures are in place.

Who can apply?

Applications for new general-purpose zones are made by a public or public-type corporation (this could include port authorities, cities, counties, economic development organizations, or others). If the zone is approved, this organization is referred to as the "grantee."

The grantee then may apply for expansions to the zone, manufacturing, or subzone authority on behalf of interested companies.