Tax Incentives

Data Center Retail Sales & Use Tax Exemption

Virginia offers a data center retail sales and use tax exemption (DCRSUT Exemption) on qualifying computer equipment or enabling software purchased or leased for use in certain data centers in the Commonwealth meeting minimum investment and job creation requirements as outlined below.

The DCRSUT exemption is available beginning July 1, 2010, through June 30, 2035, unless the company meets the investment and job creation provisions required for an extension of the DCRSUT outlined further below.

Eligibility

- The data center may be an enterprise or a colocation data center.

- Prior to using the DCRSUT Exemption, a data center must enter into a Memorandum of Understanding (MOU) with the Virginia Economic Development Partnership (VEDP) setting forth the terms and conditions of use. The MOU will set forth the data center facilities in the specific Virginia locality for which the data center will purchase or lease qualifying computer equipment or enabling software and will be using the DCRSUT Exemption.

- A colocation data center will enter into an MOU permitting both the data center and its tenants, together, to qualify for and use the DCRSUT Exemption.

Statutory Minimum General Eligibility Thresholds:

- $150 million new capital investment.

- 50 new jobs located at the data center in the applicable locality and associated with the operation or maintenance of the data center.

- Each new job must be paid at least 150% of the prevailing annual average wage in the locality where the data center is located, excluding fringe benefits.

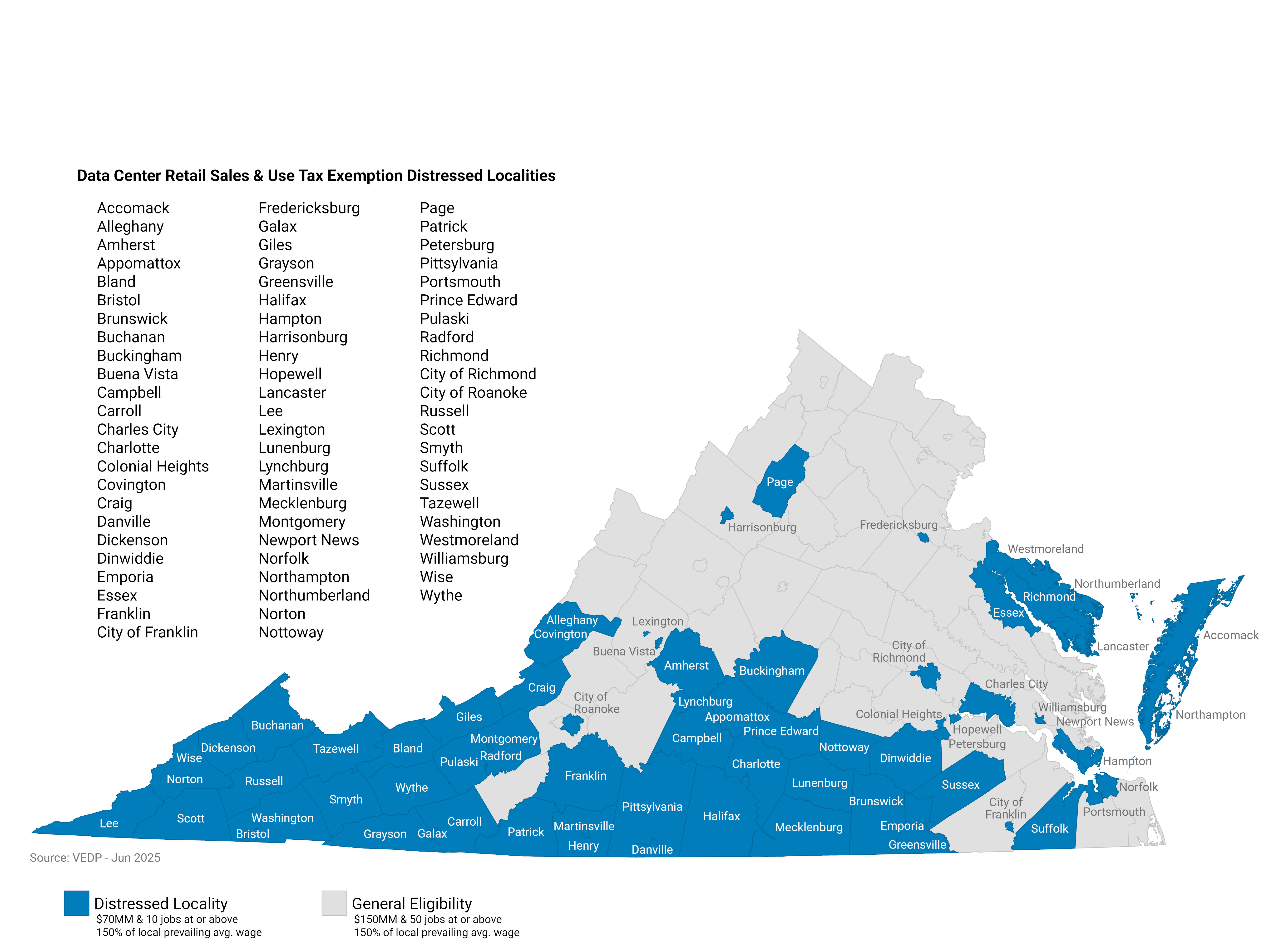

Statutory Minimum Eligibility Thresholds for Distressed Localities:

- After July 1, 2023, for a data center in a locality with annual unemployment and poverty rates that were greater than the state average.

- $70 million capital investment.

- 10 new jobs associated with the operation or maintenance of the data center in the locality.

- Each new job must be paid at least 150% of the prevailing annual average wage in the locality where the data center is located, excluding fringe benefits.

Extension of the DCRSUT Exemption beyond 2035 requires a data center operator to enter into a MOU with the VEDP on or after January 1, 2023.

Eligibility Thresholds for Extension of the Tax Exemption to 2040:

- $35 billion new capital investment in data centers in localities identified in a memorandum of understanding.

- 1,000 direct new jobs located at data centers identified in the MOU.

- At least 100 of the new jobs must be paid at least 150% of the prevailing annual average wage in the locality where the data center is located, excluding fringe benefits.

Eligibility Thresholds for Extension of the Tax Exemption to 2050:

- $100 billion new capital investment in data centers in localities identified in a memorandum of understanding.

- 2,500 direct new jobs located at data centers identified in the MOU.

- At least 100 of the new jobs must be paid at least 150% of the prevailing annual average wage in the locality where the data center is located, excluding fringe benefits.

The data center and its tenants, as may be applicable, may use the DCRSUT Exemption prior to meeting the statutory minimum capital investment, new job, and wage thresholds subject to the requirement that if such thresholds are not met by a certain performance date, the value of the DCRSUT Exemption received will be repaid to the Commonwealth.

The data center and its tenants, as may be applicable, generally must meet the statutory minimum capital investment, new job, and wage thresholds within three years after the data center and VEDP have entered into the MOU.

A data center and its tenants may use the DCRSUT Exemption for qualifying computer equipment or enabling software used for the processing, storage, retrieval, or communication of data, including but not limited to servers, routers, connections, and other enabling hardware, including chillers and backup generators used or to be used in the operation of the equipment.

The following property qualifies for the DCRSUT Exemption:

- Servers, mainframes, network infrastructure, data storage hardware, and other computer equipment to the extent used for the processing, storage, retrieval, or communication of data.

- Cabling, switches, directors, wiring, and similar items to the extent used in the operation of exempt equipment, but not general building improvements or other fixtures.

- Generators, radiators, exhaust fans, fuel storage tanks, and similar items to the extent used to provide electricity, but not fuel otherwise subject to retail sales and use tax.

- Electrical substations, power distribution equipment, cogeneration equipment, batteries, and other electrical equipment to the extent used to provide electricity.

- Chillers, computer room air conditioners (CRACs), heating, ventilating, and air conditioning (HVAC) systems, cool towers, and similar items to the extent used to provide the proper environment in the data center, e.g., temperature and humidity.

- Water storage tanks, water pumps, piping, and similar items to the extent used to operate chillers and other cooling systems to provide the proper environment in the data center, e.g., temperature and humidity.

- Monitoring systems used to monitor the data center’s power generation, transmission, and distribution equipment, to the extent such systems are used to exercise remote control over exempt equipment and to identify specific repair and maintenance needs of exempt equipment, but not equipment used for external surveillance and security and tangible personal property, such as fire and burglar alarm systems, which would be considered general building improvements.

- Cabinets, battery racks, and cable trays specifically designed to ensure that the servers and other exempt equipment function properly.

- Software used for the processing, storage, retrieval, or communication of data when it is sold or leased with the exempt equipment, but not when it is sold or leased separately.

- Custom software which is not prewritten and is specifically designed and developed for only one customer.

General upgrades to the data center facility such as repairing or replacing roofs, lighting, fencing, and other general building improvements or fixtures are not qualifying computer equipment.

Process

- MOU and Exemption Certificate

- Initiated with VEDP’s Division of Incentives.

- The data center and the Division of Incentives negotiate and execute the MOU.

- The Division of Incentives provides the MOU to the Virginia Department of Taxation (TAX) for review.

- TAX issues an Exemption Certificate directly to the data center

- Participation Certificate and Agreement and Exemption Certificate

- A tenant of a colocation data center that already has an MOU with VEDP separately must enter into a Participation Certificate and Agreement with such data center.

- The colocation data center provides the Participation Certificate and Agreement to the Division of Incentives, which in turn provides it to TAX for review.

- TAX issues an Exemption Certificate directly to the tenant.

- To qualify for the DCRSUT Exemption, the purchase or lease of the qualifying computer equipment must be made after the Exemption Certificate effective date.

- The effective date is the date of the MOU between the data center and VEDP.

Annual Reporting Requirements:

- The data center and any tenants, if applicable, must keep complete and accurate records of the:

- Amount of capital investment

- Number of new jobs

- Average annual wage of each new job

- Amount of expenditures on qualifying computer equipment or enabling software

- Value of the DCRSUT Exemption received

- A data center must make an annual report on behalf of itself and any tenants, if applicable, to VEDP and TAX of the progress made toward achieving the performance targets for the exemption.

- A data center must make a final report on behalf of itself and any tenants, if applicable, to VEDP and TAX upon achievement of the performance targets and include such information as required by the annual report.

- The capital investment and new jobs information reported by the data center is subject to verification.

- If the final report demonstrates that the data center failed to achieve the performance targets as of the performance date, the data center and its tenants immediately will cease using the DCRSUT Exemption and the value of the tax benefit received must be repaid to the Commonwealth.

If at any time prior to the performance date, the data center itself or VEDP determines that the data center will be unable to meet the performance targets as of the performance date, the data center and its tenants immediately will cease using the DCRSUT Exemption and the value of the tax benefit received must be repaid to the Commonwealth.

Ongoing Reporting Requirements:

- A data center must continue to provide annual reports on behalf of itself and any tenants, if applicable, to VEDP and TAX outlining the following information:

- Amount of capital investment

- Total data center jobs

- Average annual wage of data center jobs

- Amount of expenditures on qualifying computer equipment or enabling software

- Value of the DCRSUT Exemption received

FAQ

Is it mandatory that new jobs are hired in the same locality as the data center in order to count as qualifying?

Yes.

Can a tenant of a colocation data center use the tax exemption?

Yes. A tenant of a colocation data center must enter into a Participation Certificate and Agreement (Participation Certificate) with a colocation data center that has an MOU in order to use the exemption on qualifying equipment.

When is the retail sales and use tax due?

Retail sales and use tax is due when such property is either (i) delivered to the purchaser, or (ii) paid for in full by the purchaser, whichever occurs first, regardless of when the property is ordered. As such, this is when the exemption must be claimed. This is not a refund given after paying the sales and use tax.

Can a company move jobs to a data center to count as its qualifying jobs?

A company cannot move jobs from one Virginia locality to another, but may move jobs from outside of Virginia as long as they meet the other criteria for net new jobs.

Can a company move used property to a data center to count as its qualifying investment?

The value of used property transferred by a data center to the specific Virginia locality generally will not count as new capital investment.

What happens if a company does not meet the statutory minimum requirements for capital investment and job creation?

The company will be responsible for paying the value of the foregone sales and use tax in its entirety plus interest.