Discretionary Incentives

Virginia Investment Performance Grant (VIP)

The Virginia Investment Performance Grant (VIP) encourages continued capital investment by existing Virginia companies, resulting in added capacity, modernization, increased productivity, or the creation, development, and utilization of advanced technology. The program targets existing manufacturers or research and development services supporting manufacturing. There must be an active and realistic competition between Virginia and another state or country for attracting the project, and matching local financial participation is expected.

The amount of each VIP grant is determined by the Secretary of Commerce and Trade, based in part on the Virginia Economic Development Partnership’s (VEDP) Return-on-Investment analysis and recommendation, and is subject to the approval of the Governor.

Eligibility

All projects must meet the following eligibility requirements:

- Project must be affiliated with a basic employer, meaning 51% or more of the facility’s revenue must be generated outside the Commonwealth.

- There must be an active and realistic competition between Virginia and another state or country for attracting the project.

- Matching local financial participation of at least 50% is expected.

- The project must result in capital investment of at least $25 million.

- “Capital investment” means an investment in real property, tangible personal property, or both at a manufacturing or basic nonmanufacturing facility within the Commonwealth that is capitalized by the company. Expenditures for maintenance, replacement, or repair of existing machinery, tools, and real property shall not constitute a capital investment; however, expenditures for the replacement of property shall not be ineligible for designation as a capital investment if such replacement results in a measurable increase in productivity.

- The company must be a manufacturer or research and development service that supports manufacturing.

- "Manufacturer" means a business firm owning or operating a manufacturing establishment as defined in the Standard Industrial Classification Manual issued by the U.S. Office of Management and Budget or the North American Industry Classification System Manual issued by the United States Census Bureau.

- “Research and development service” means a business firm owning or operating an establishment engaged in conducting research and experimental development that supports manufacturing in the physical, engineering, and life sciences as defined in the North American Industry Classification System Manual issued by the United States Census Bureau.

- The company applying must have a legal presence within the Commonwealth for at least three years prior to making the announcement of the project.

- Although no minimum new job creation is required for a VIP grant, the investment must not result in any net reduction in employment from the date of completion of the capital investment through one year from the date of completion.

- "New job" means employment of an indefinite duration, created as the direct result of the private investment, for which the firm pays wages and standard fringe benefits for its employee, requiring a minimum of either (i) 35 hours of the employee's time a week for the entire normal year of the firm's operations, which "normal year" must consist of at least 48 weeks or (ii) 1,680 hours per year. If there are existing jobs at the firm’s facility, it is expected that the performance agreement will state the number of existing jobs and will require that any new jobs be in addition to the existing jobs.

- At the discretion of VEDP, jobs may include teleworking positions, held by Virginia residents, who are employees of the recipient company or its affiliates.

- Any grant award determination that includes new job creation will require that the jobs included in the grant award pay an average wage, excluding fringe benefits, that is no less that the prevailing average wage of the locality being considered.

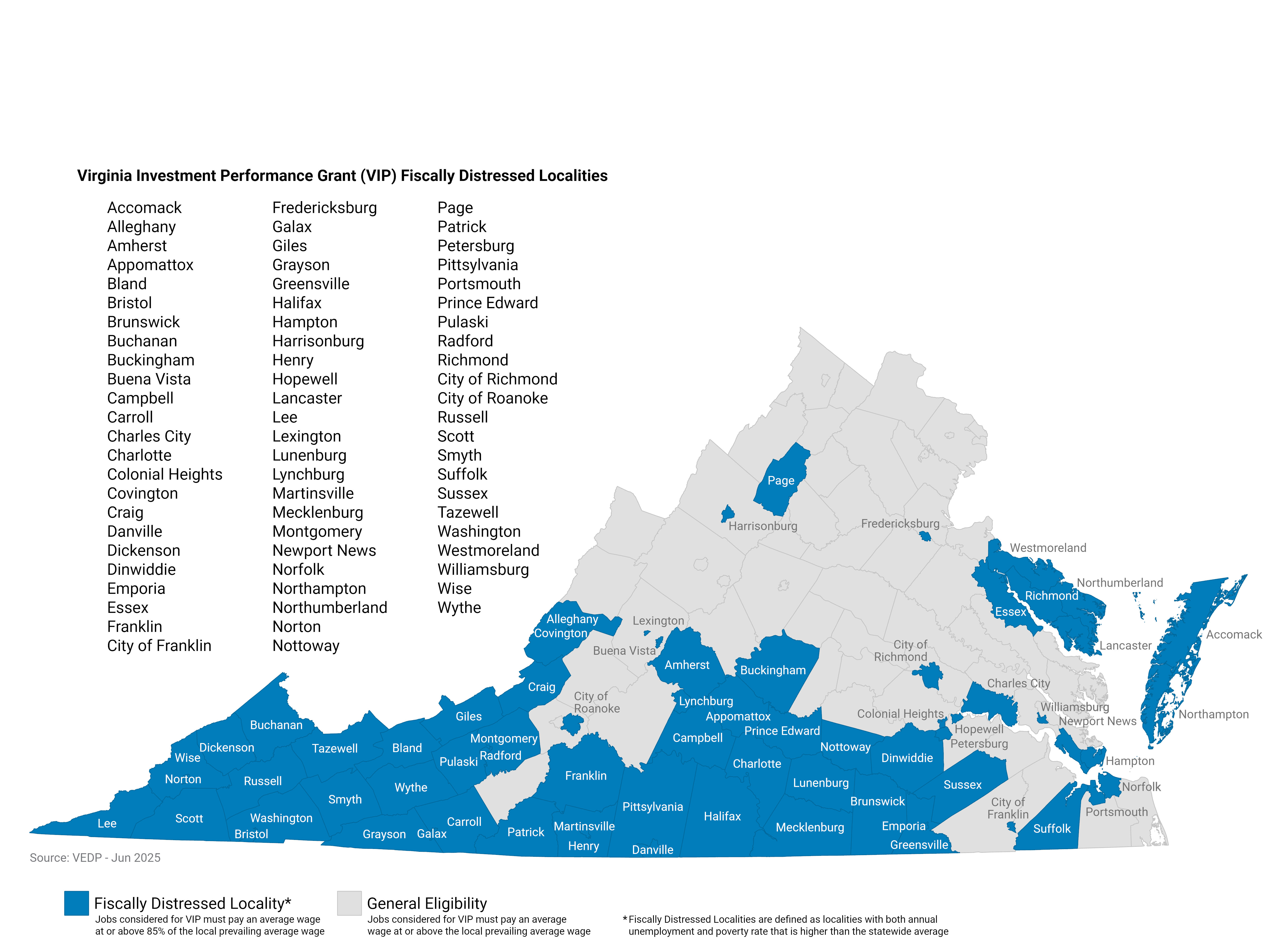

- The average annual wage for the new jobs must be at least equal to the prevailing average annual wage in the locality, excluding fringe benefits. For double distressed localities, jobs must pay at least 85% of the prevailing average annual wage in the locality, excluding fringe benefits.

Public announcement of the project must be coordinated by VEDP and the Governor’s Office.

Process

- The project is initiated with a VEDP Business Investment Manager.

- Due Diligence Review – In order for a VIP grant to be awarded, projects are subject to a due diligence review process. During this process, the VEDP Business Investment Manager will work with the company to attain the information required to begin the project review process, including company information, financials, non-disclosure agreement, and investment and jobs information.

- VEDP then performs a Return-on-Investment (ROI) analysis and risk assessment for the project.

- The project is then reviewed by VEDP’s Project Review and Credit Committee (PRACC) (1-2 weeks, subject to all necessary documentation being provided).

- If approved by PRACC, the proposed incentive award is forwarded to the Secretary of Commerce and Trade for preliminary approval (approximately 1 week).

- VEDP delivers a financial proposal to the company.

- The company accepts or rejects the offer.

- A VIP application is completed and submitted. Applications will be provided by VEDP for company signature and submission.

- A performance agreement is drafted and reviewed by the company.

- The Governor gives final approval or rejection (approximately 2 weeks).

- A press release is issued and/or an announcement event is scheduled.

- VIP grants are paid in five equal annual installments beginning in the first year after the capital investment and job creation or retention are achieved.

- At no time shall the aggregate amount of grants payable in any fiscal year exceed $7 million.

- No VIP Grant awarded shall exceed $5 million in total, an no annual payment shall exceed $1 million.

The company will be asked to provide annual reports indicating progress toward achieving its capital investment and employment performance targets. Reports include:

- Initial Company Notification – The performance agreement will require the company to notify VEDP in writing within 90 days of completion of the capital investment and any new job creation or existing job maintenance, certifying the amount of capital investment and, if applicable, the number of net new jobs created and maintained at the facility, the average annual wage rates paid to such employees, and a summary of the fringe benefits package offered by the company to a typical employee.

- Subsequent Company Notification – The performance agreement will require the company to notify VEDP in writing one year after the Initial Company Notification indicating whether there has been a net reduction in employment from the date of the completion of the capital investment through one year thereafter (for any VIP grants awarded prior to July 1, 2024).

- Annual Progress Report – During the performance period and the payout period for the VIP grant, the company will be asked to annually verify the level of capital investment, new jobs, and wages, and (during the payment period) to note whether the facility continues to be operated at substantially the same level as existed at the time that the capital investment was completed.

- Verification of New Jobs: Companies will be asked to report the number of jobs created and maintained through the performance period and the payment period, and the average annual wage for those jobs.

- Verification of Capital Investment: Companies will be asked to report the amount and type of capital investment made through the performance period, by broad categories (e.g., land, land improvement or machinery, fixtures and equipment).

Resources

FAQ

How are awards calculated?

There is no formula for calculating the amount of the grant award. In determining grant amounts, the following criteria are considered: a Return-on-Investment (ROI) analysis, new jobs, wage levels, overall employment, capital investment, area and regional unemployment, poverty and fiscal stress, the locality’s financial support of the project, and company growth potential.

How long must the company have a presence in Virginia to be eligible for the program?

The company must have a legal presence within the Commonwealth for at least three years prior to making the announcement of capital investment to be eligible for the program.

How long does the company have to make its qualifying investment?

In general, project completion will occur within three years, but no more than five years, from the date the performance agreement is signed.

Can used equipment moved to a project site count as qualifying capital investment?

Generally, the value of used equipment transferred by the company to the project site will not count as qualifying capital investment.

What happens if the statutory minimum is not met or maintained?

If the company does not achieve the statutory minimum capital investment requirement of $25 million or does not maintain at least steady employment in the one-year period after completion of the capital investment, no VIP grant payment will be made. If the company achieves the statutory minimum capital investment and maintains steady employment but does not achieve at least 50% of the capital investment goal and any jobs goal stated in the performance agreement, no VIP grant payment will be made.

What happens if capital investment does not remain in place or if employment is not maintained during the payout period?

Failure to maintain capital investment or net employment agreed upon in the performance agreement will require the company to provide immediate notice to VEDP. In this event, the installment payments on the VIP grant will cease, but the VIP grantee will not be required to return any VIP grant installments previously paid.

What is non-qualifying capital investment?

Expenditures for maintenance, replacement or repair of existing machinery, tools, and real property shall not constitute a capital investment; however, expenditures for the replacement of property shall not be ineligible for designation as a capital investment if such replacement results in a measurable increase in productivity.

What positions do not qualify as new jobs?

Seasonal or temporary positions, positions created when a job function is shifted from an existing location in the Commonwealth, and positions with construction contractors, vendors, suppliers, and similar multiplier or spin-off jobs shall not qualify as new jobs.

Are contract employees allowed to count as new jobs?

The Commonwealth will consider dedicated, full-time, Virginia-based contractors as eligible net new jobs should the company desire to count them toward the new job targets. The requirements for contract positions are the same as those positions on the company’s payroll and would be required to meet the same requirements as a “new job.”

Can the company receive multiple VIP grants?

An applicant may be granted more than one VIP grant at a time if the scope of each project has a different timeframe and independently meets the minimum investment and all other criteria.

What can VIP funds be used for?

There are no restrictions on how VIP funds may be allocated.

What programs are included within the Virginia Investment Partnership Act?

The Virginia Investment Partnership Act comprises the Virginia Investment Performance Grant (VIP), the Major Eligible Employer Grant (MEE), and the Virginia Economic Development Incentive Grant (VEDIG).

Can the company participate in multiple performance incentive programs under the Virginia Investment Partnership Act at the same time?

Companies are only allowed to participate in one program per project under the Virginia Investment Partnership Act at any given time.

How is "standard fringe benefits" defined?

For the purposes of the VIP, standard fringe benefits means the company offers at a minimum, health insurance (either as a company sponsored program or in the form of subsidized health insurance) and Paid Time Off (PTO) to employees of at least 40 hours annually.